Home Buying

My experience with renting and home buying is limited to Boston-Suffolk Country housing market area, where the owner vacancy rate was just 0.4 percent in 2016 so much of my advice is specific though some of it is still general.

I made this page with myself in mind as a reminder that research is a part of the purchase that I actually enjoyed compared the unpleasant parts of being sold to by buyer’s agent and mortgage brokers.

In my case, I started out renting so I knew that I wanted to stay in the area and started playing with “Rent vs Buy” calculators (available at nytimes.com, FreddieMac, and more,) which helped me learn about the costs of renting compared to buying.

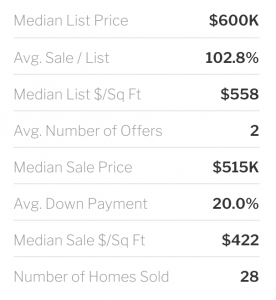

Once I knew I it was time to try to own my home, I started by viewing a zipcode’s market overview from Redfin which includes trends for Median List Price, Avg. Sale / List, Median List $/Sq Ft, Avg. Number of Offers, Median Sale Price, Avg. Down Payment, Median Sale $/Sq Ft, Number of Homes Sold. Just go to redfin.com and search for a zipcode.

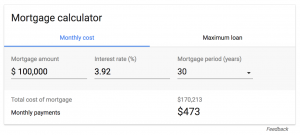

Next, I like playing with some numbers in Google’s mortgage calculator because it is dead simple. You’ll quickly see approximately what you can afford. The more scenarios you try, the more you’ll learn; I suggest trying 15 year terms and also watching what happens as the interest rate increases. You can find about approximately what you can afford from a calculator like this one, and what the factors are such as monthly income, monthly debt payments and the size of your down payment.

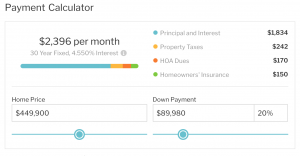

From there its worth educating yourself about how the steps from a resource like this one, but the most important step is just to start looking and for that I once again recommend Redfin. Redfin has a great search experience, has access to all of the same listings that any real estate agent does and their payment calculator is excellent.

I finished the process with very strong opinions about a few things.

In Boston, the value of a buyer’s agent is low for well informed buyers. All of the listings are available for free online. All of their contacts are only a Google search away. All of their knowledge about things to watch for can be gleened from Youtube. The help they provide with the process is available either for free (with ample research) or at a much reduced fee from companies like Redfin. Still, despite much of their job being superseded with technology, their 2%-3% commission has barely changed in decades and they are highly incentivized to close deals so they can move on to the next customer. My advice: only use a buyer’s agent if you think you need someone to coach you through all the paperwork and lawyers (or perhaps if you’re in a very different market from me.) All of that said, our agent did a great job but it sure would have been nice to get a Redfin refund at the end.

Tax savings are not guaranteed. It still pisses me off that our mortgage broker repeatedly pushed that we were failing to account for tax savings when calculating what we could afford. You should do the math and check it twice, especially with the double-size standard deductions coming from the Trump tax cuts. The basic premise that you can deduct your interest payments and property taxes on your federal tax return. Use a calculator like this one.

The value of a mortgage broker is basically just a paper pusher. Decide for yourself and read something like Choosing Between Mortgage Broker and Bank (nytimes.com). Our broker seemed to just push all the paper down to inexperienced young assistants who were handling tons of clients and kept getting things confused and then our loan was immediately sold. Perhaps my biggest regret, is not using a local bank as my lender since then I could have just done all the paperwork directly with the source and I’d be able to go talk to someone at any time.